Listen to the article

Trust funds are a critical resource in ADB operations. They provide additional funds for projects that contribute to ADB’s vision. Trust funds may finance loans, grants, technical assistance, guarantees, risk participations, equity investments, and other activities agreed upon between ADB and the financing partner.

trust funds at a glance

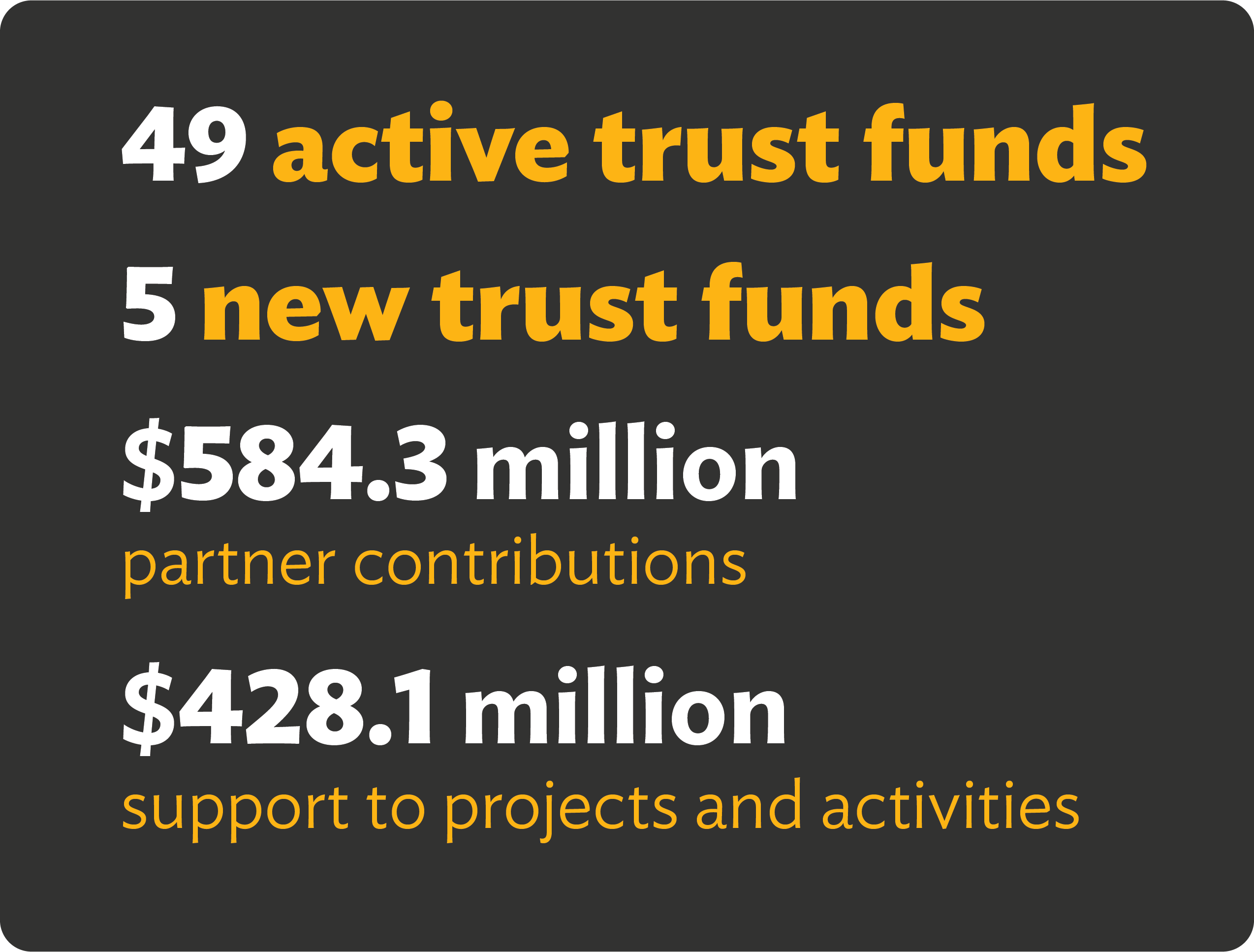

Trust funds support ADB’s efforts to improve people’s well-being and empowerment, care for a healthy planet, and drive economic growth and prosperity. In 2024, ADB established five new trust funds and secured $584.3 million in new contributions committed by external partners. The bank also focused on donor visibility and stronger engagement with financing partners.

2024 Operations

An ADB trust fund may be established as a stand-alone initiative or under a financing partnership facility (FPF). An FPF is an operational mechanism for strategic, long-term, and multi-partner cooperation. It links various forms of assistance in a coordinated manner for a well-defined purpose. A trust fund may be established with a single financing partner or multiple financing partners

Active Funds in 2024

Trust funds allow ADB to support various priority development sectors, including climate change, poverty reduction, agriculture, finance, natural resources and rural development, communication technology, energy, transport, education, health, water, public sector management, and industry and trade.

As of the end of 2024, ADB administered 49 active trust funds with 35 financing partners. Of the active trust funds, 28 are stand-alone trust funds, while 21 are under financing partnership facilities (FPFs).

In 2024, the bank had five new trust funds to improve climate and disaster resilience in the Asia and Pacific region, and an innovative financing mechanism for the education sector.

Download the list of active ADB trust funds as of December 2024.

New Trust Funds

Contributions Committed by External Partners

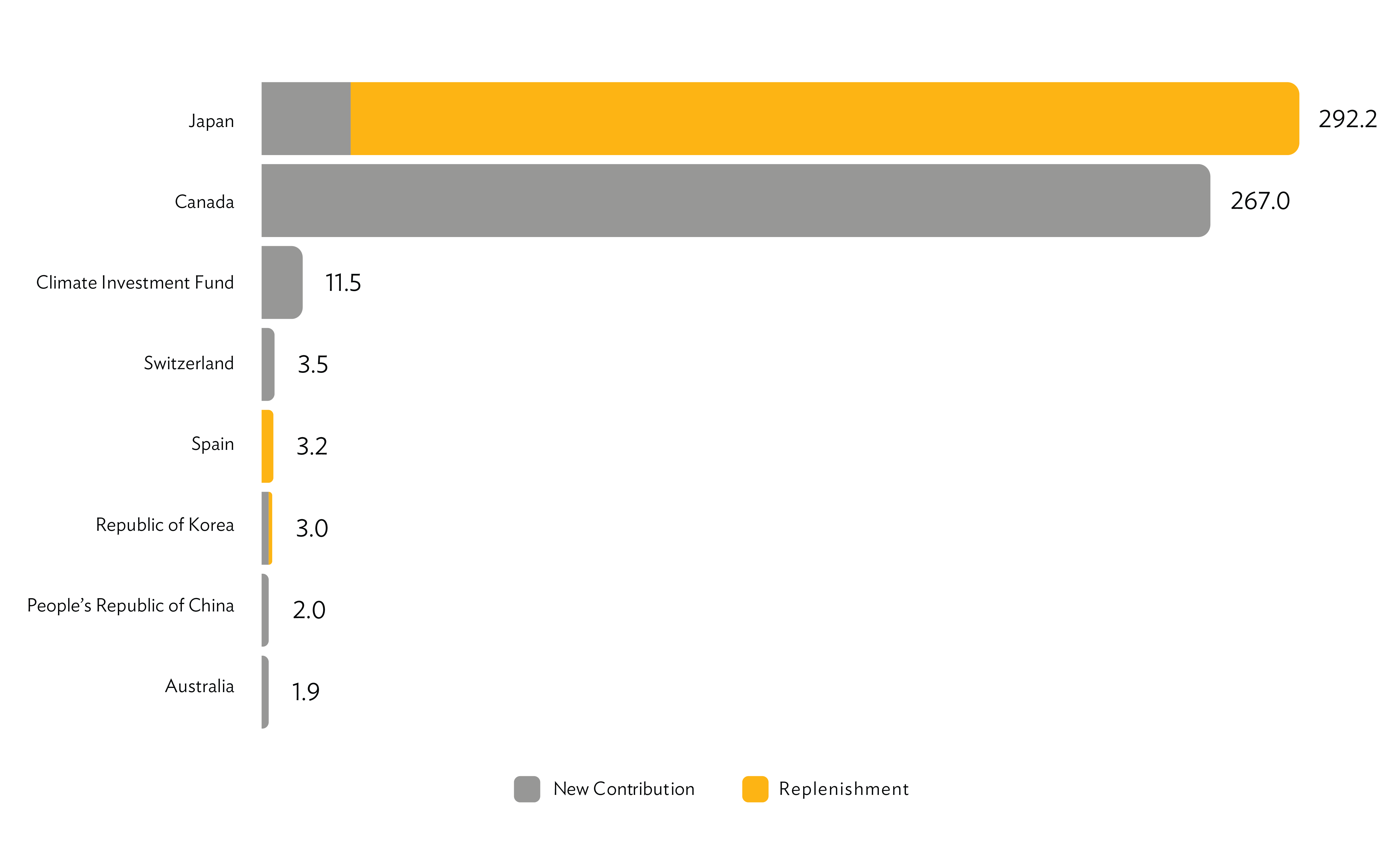

Financing partners play a vital role to ADB’s trust fund operations, providing both financial and knowledge support that enables ADB to better serve the needs of its member countries. In 2024, financing partners committed to contribute a total of $584.3 million to ADB trust funds.

The commitments from partners include new contributions and replenishments. New contributions refer to commitments made to newly established funds or by new partners to existing funds. Replenishments, on the other hand, are additional contributions to previously supported trust funds.

2024 Contributions Committed by Source (in $ million)

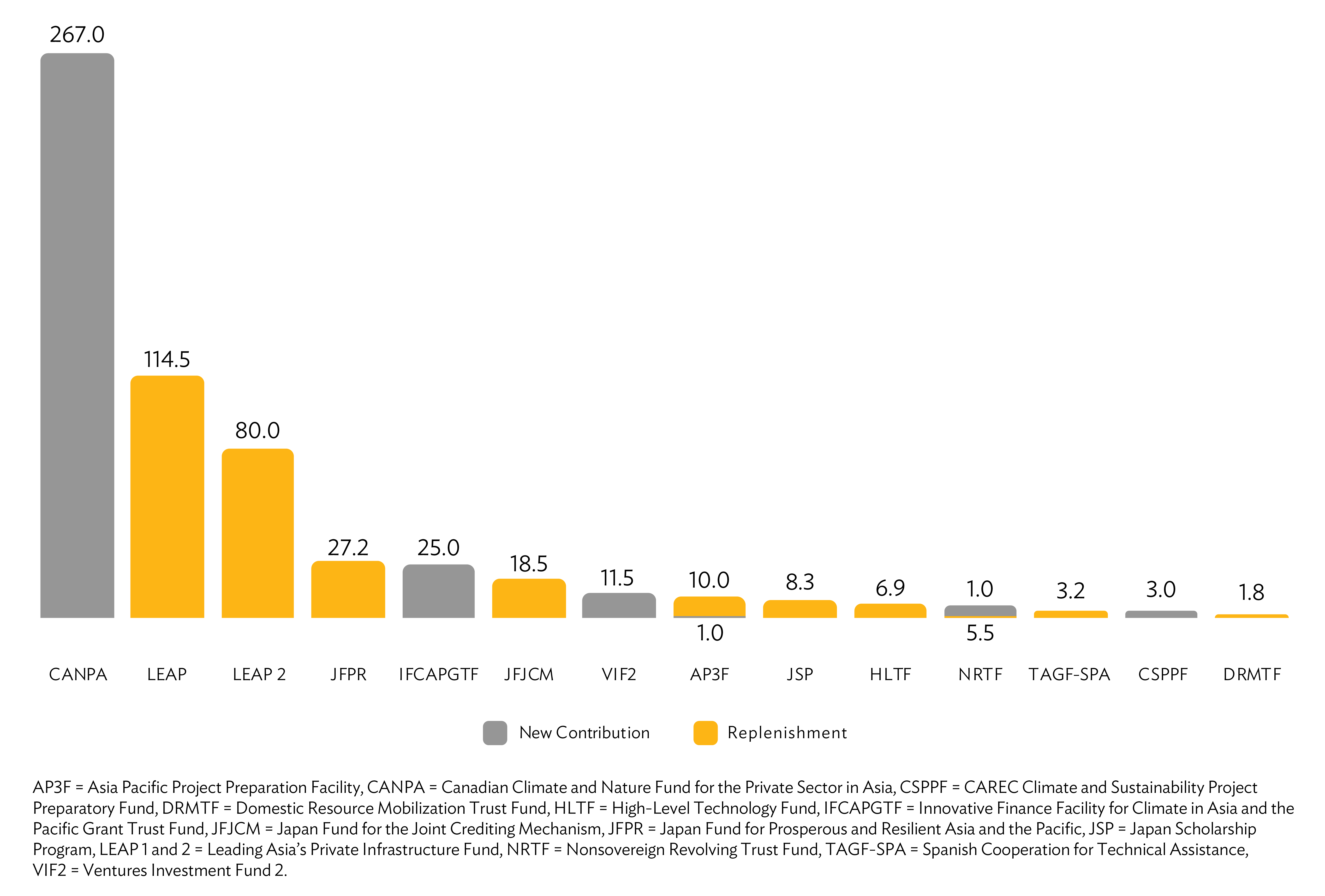

Japan led the commitments with $292.2 million—half of total contributions to trust funds— spread across nine trust funds. Canada followed closely with $267 million (46% of the total) to the new Canadian Climate and Nature Fund for the Private Sector in Asia, or CANPA. Established in March 2024, CANPA will help ADB’s developing member countries cut carbon emissions, transition to low-carbon pathways, and finance nature-based solutions to ensure sustainable ecosystem protection.

Next to CANPA, the Leading Asia’s Private Infrastructure Fund (LEAP), and subsequently LEAP 2, supported by the Government of Japan, received the biggest contribution commitments in 2024.

2024 Contributions Committed by Fund (in $ million)

How Trust Fund Resources Were Used

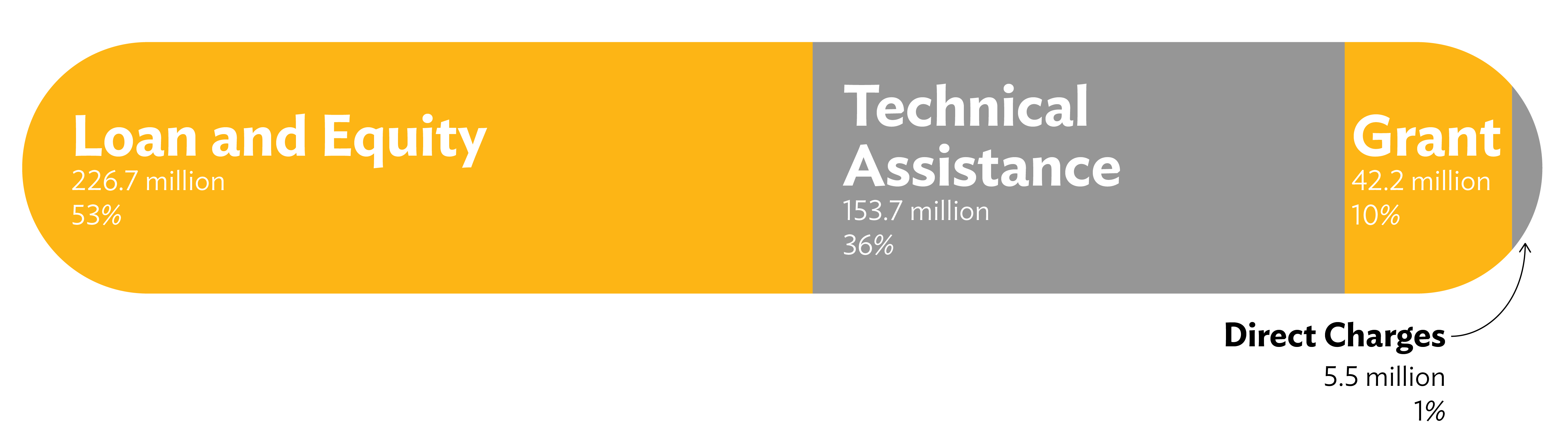

ADB operations in 2024 utilized $428.1 million of trust fund resources. More than half (55% or $233.8 million) supported ADB’s nonsovereign operations and about 44% ($188.8 million) cofinanced sovereign projects. Direct charges—activities or operation-related expenditures like training programs, workshops, and inputs from experts directly from a trust fund without creating a project—consumed $5.5 million or around 1%.

Total Support to Projects and Other Activities

These resources were channeled through loans and equity, grants, technical assistance, and direct charges. Total loans and equity cofinancing reached $226.7 million in 2024. Of this amount, $46 million or 20.3% will finance the development, construction, and operation of the 445-megawatt Bilasuvar Solar Power Project in Azerbaijan.

Total technical assistance reached $153.7 million, the biggest share of which went to a regional project that will help developing member countries craft infrastructure projects that attract more private investments. Some $42.2 million went to grants while $5.5 million was used for direct charges.

Strengthening Engagement

A OneADB team forged new operational and knowledge partnerships with leading British private, scientific and financial institutions in England, Scotland and Wales.

In 2024, ADB actively engaged with trust fund donors through key events, fostering collaboration and scaling up development efforts. These engagements reflect ADB’s commitment to working closely with partners to drive impactful and sustainable development across Asia and the Pacific.

ADB-UK Roadshow. During the ADB-UK Roadshow held from 19 to 23 August 2024, ADB and the United Kingdom’s (UK) Foreign Commonwealth and Development Office (FCDO) reaffirmed their commitment to deepening their partnership. Among the roadshow’s outputs are a 2-year development workplan for joint implementation and monitoring, opportunities identified for increasing ADB’s visibility within the UK, and discussions on cofinancing opportunities between ADB and International Finance Facility for Education (IFFEd). The ADB–IFFEd partnership provides developing member countries with a transformational financing mechanism of grants and guarantees that support education initiatives.

ADB and partners announced the start of Innovative Finance Facility for Climate in Asia and the Pacific (IF-CAP) operations at the 29th Conference of the Parties to the UN Framework Convention on Climate Change (COP29) in Baku, Azerbaijan.

Innovative Finance Facility for Climate in Asia and the Pacific Kick-Off. To mark the commencement of operations of the Innovative Finance Facility for Climate in Asia and the Pacific, ADB hosted a kickoff event at COP29 in Baku, Azerbaijan. Then ADB President Masatsugu Asakawa was joined by senior officials from IF-CAP’s partners Australia, Denmark, Japan, the Republic of Korea, Norway, Sweden, the United Kingdom, and the United States. IF-CAP is a strategic initiative featuring a leveraged guarantee mechanism to mobilize climate finance at scale. IF-CAP’s $2.5 billion in anticipated guarantees is expected to unlock over $11 billion for climate action.

Ocean Resilience and Climate Adaptation Trust Fund (ORCATF) Annual Partnerships Meeting. From 15–16 October, ADB hosted the second ORCATF Annual Partnerships Meeting, reviewing progress from its first year of operations and refining implementation strategies.

ADB and financing partners discussed measures to increase donor visibility and engagement in operations supported by trust funds under the Clean Energy, Urban and Water financing partnership facilities.

Annual Financing Partnership Facilities Donor Consultation Meeting. ADB also convened financing partners at the Annual Donor Consultation Meeting in Manila from 16–18 October 2024. The consultation focused on the Clean Energy, Urban, and Water Financing Partnership Facilities. This consultation saw broader participation, including new donors such as the People’s Republic of China, Ireland, Luxembourg, and Taipei,China. Attendees visited ADB-supported projects before engaging in discussions on strengthening donor collaboration, boosting visibility, and expanding opportunities for trust fund-supported initiatives.

Representatives from ADB and the Ministry of Finance of Japan reviewed the 2024 achievements of Japan Fund for Prosperous and Resilient Asia and the Pacific and the Japan Special Fund, including operational enhancements of the High-Level Technology Fund and the ADB-Japan Scholarship Program.

ADB-Japan Funds Annual Consultation Meeting. ADB and Japan’s Ministry of Finance met on 11 December for the ADB-Japan Funds Annual Consultation Meeting to assess achievements in 2024 and set priorities for 2025 of the Japan Fund for Prosperous and Resilient Asia and the Pacific, the Japan Special Fund, the High-Level Technology Fund and the ADB-Japan Scholarship Program. This was followed by the JSP Welcome Gathering, where new scholars were encouraged to contribute to development in their home countries.

ADB and officials of the Ministry of Economy and Finance discussed ways to strengthen the partnership between ADB and the Republic of Korea considering growing expectations for ADB to help DMCs address their development challenges.

ADB-Republic of Korea High Level Consultations. ADB also deepened ties with the Republic of Korea through a high-level consultation meeting (5–6 November), where Vice-President Scott Morris engaged with senior officials on climate finance and private sector collaboration.

ADB-Japan Roadshow. From 1 to 5 July 2024, ADB led a mission to Tokyo, Yokohama and Tsukuba, Japan and met with senior officials of the Government of Japan and representatives from the private sector. During the 5-day period, the ADB delegation agreed to share knowledge on a new Green Facility with the Japan Bank for International Cooperation and the University of Tokyo. Based on the outcome of the mission, a follow-up plan was developed, and significant progress has been made. This includes the formation of the Asia Zero Emission Community (AZEC) working group between ADB, the Ministry of Economy, Trade and Industry (METI) of Japan, and the Economic research Institute for ASEAN and East Asia (ERIA). Additionally, a technology for development forum, which was an outcome of the mission, is also being planned during 2025.

Other engagements. Other key engagements included the Asia Clean Energy Forum (3–7 June), co-organized with the Korea Energy Agency and USAID, bringing together 1,200 stakeholders to discuss how to accelerate clean energy investments, and the ADB Ventures Fund 1 Participants Meeting (28–30 August) in New Delhi, where investors, partners, and startup founders discussed funding strategies and market trends. Finland’s Ministry of Foreign Affairs, the Clean Technology Fund, the Nordic Development Fund, the Republic of Korea’s Ministry of Economy and Finance, and the Korea Ventures Investment Corporation, and eight CEOs and founders from the portfolio companies—Euler Motors, Revfin, InnoCSR, Tiger New Energy, IBISA, Smart Joules, Electrifi, and SatSure—joined the meeting.

Closed Funds

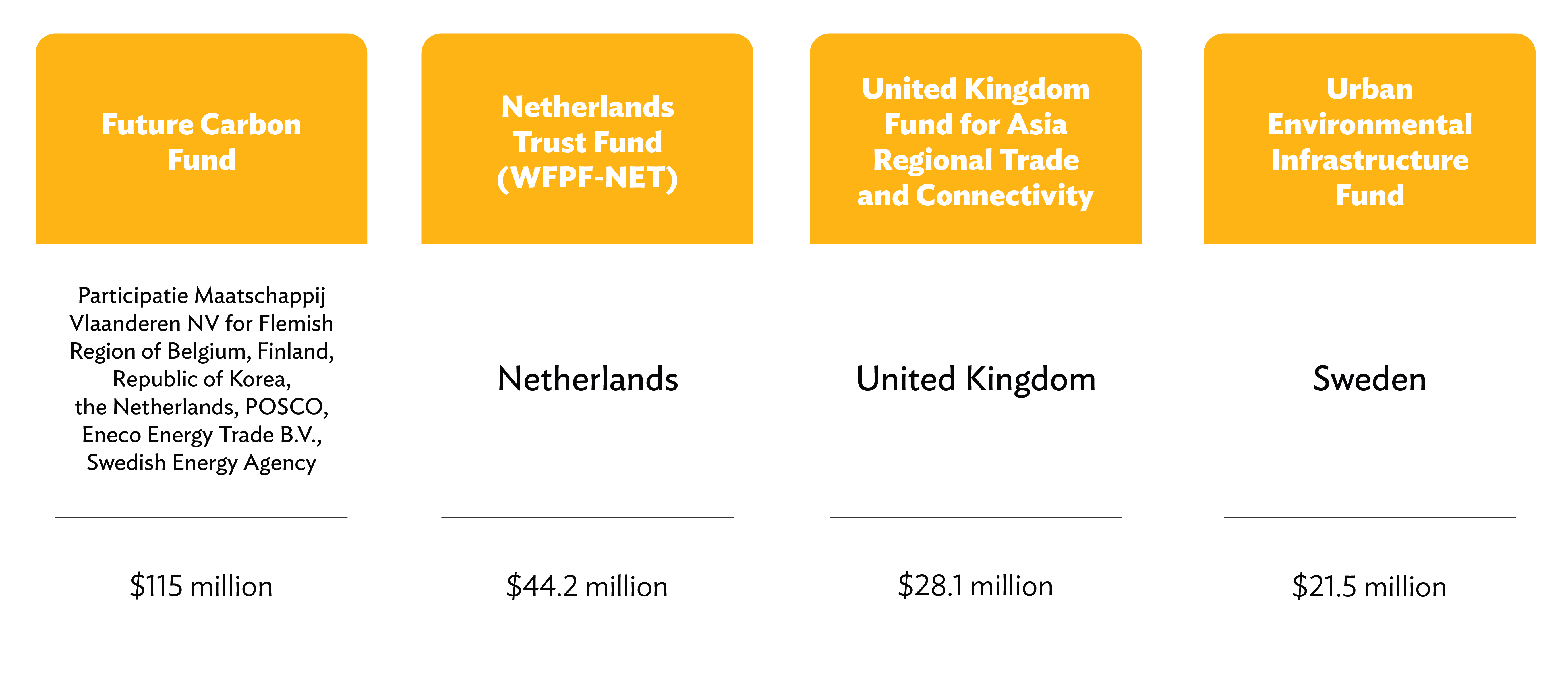

Four trust funds closed in 2024. These are the multi-donor Future Carbon Fund, the Netherlands Trust Fund under the Water Financing Partnership Facility, the United Kingdom Fund for Asia Regional Trade and Connectivity, and the Urban Environmental Infrastructure Fund.

Funds that Closed in 2024

Future Carbon Fund

The Future Carbon Fund (FCF) provided carbon finance to incentivize investments in 33 climate mitigation projects across 10 developing member countries. These projects avoided over 8 million tons of carbon dioxide emissions while delivering numerous social, environmental, and economic benefits.

Over 15 years, the FCF demonstrated the value of long-term, fixed-price carbon credit purchases and upfront payments, which helped reduce financial risks and encouraged investments in low-carbon technologies and solutions.

The Future Carbon Fund and the Tata Power Community Development Trust financed the establishment of a canteen at a school near the FCF-supported Khandke Wind Farm in Ahmednagar, Maharashtra, India (2017-2018).

Netherlands Trust Fund

The Netherlands Trust Fund (WFPF-NET) was ADB’s first single-partner trust fund under the Water Financing Partnership Facility (WFPF), launched in 2007. With $44.2 million committed contributions (30% of WFPF’s total funds), the WFPF-NET played a key role in 133 investment projects supported by the WFPF, worth $11.4 billion across 23 developing countries. Close to 67 million people have already benefitted from completed projects and nearly 60 million more are expected to benefit from ongoing ones.

Over 17 years, the trust fund supported projects and activities designed to result in more people with access to safe drinking water supply and improved sanitation, higher productivity and efficiency in irrigation and drainage services, and reduced flood and other water-related risks. It also supported projects to improve water resources management, enhance sector governance, and increase water-food security.

To help farmers improve irrigation practices with real-time information, the Netherlands Trust Fund supported the development of an irrigation scheduling tool using remote sensing imagery and a customized mobile application as part of the ADB-financed Madhya Pradesh Irrigation Efficiency Improvement Project in India.

United Kingdom Fund for Asia Regional Trade and Connectivity

Established in 2018 with a $28.1 million contribution from the United Kingdom government, the Asia Regional Trade and Connectivity Fund (ARTCF) supported ADB’s regional cooperation and integration initiatives (RCI) in Central, South, and Southeast Asia. The ARTCF supported RCI activities in (i) regional electricity connectivity and trade, (ii) transport connectivity, (iii) digital connectivity, (iv) regulatory reform and broad regional trade and investment facilitation, (v) regional and/or cross-border value chains, and (vi) broader strategic issues related to connectivity investments.

It also helped formulate regional strategies that serve as frameworks for identifying, prioritizing, and preparing RCI projects, including the CAREC Transport Strategy 2030, the BIMSTEC Master Plan for Transport Connectivity, and the CAREC Tourism Strategy 2030. It also supported pilot initiatives such as the Almaty–Bishkek Economic Corridor to test innovative solutions that could be replicated and scaled up under ADB’s RCI programs.

ARTCF supported the successful conduct of a trial run of the Early Harvest of the GMs Cross-Border Transport Facilitation Agreement (CBTA) on 22-27 June 2024 to confirm road quality, traffic regulations, and border clearance procedures along the CBTA routes, and the readiness of GMS countries to implement the CBTA Early Harvest. Five container trucks and two passenger buses traveled all the way from Kunming, the People’s Republic of China to Phnom Penh, Cambodia via Lao PDR, and Thailand, using the CBTA admission documents. The lessons learned from the trial run will help expand and accelerate the implementation of the CBTA among the GMS countries.

Urban Environmental Infrastructure Fund

Established in 2009, the Urban Environmental Infrastructure Fund (UEIF) is the maiden trust fund of the Urban Financing Partnership Facility, backed by a $21.5 million contribution from the Government of Sweden. From 2009 to 2022, UEIF financed a total of 49 projects covering a range of focus areas which include water supply and sanitation, solid waste management, and air quality improvements.

In Fiji, the fund supported the improvement of wastewater and sanitation systems in Suva as part of revitalizing informal settlements. In Mongolia, UEIF financed various activities that helped improve water service delivery in Ulaanbaatar. In India, it provided a $1.3 million grant to develop community-based sanitation intervention, particularly the installation of new toilets for poor and vulnerable households in four urban local bodies.

A materials recovery facility (MRF) constructed in Battambang, Cambodia with support from UEIF under the GMS Southern Economic Corridor Towns Development Project.

Trust Funds

Stand-Alone Trust Funds

- ADB–Japan Scholarship Program

- Afghanistan Infrastructure Trust Fund

- Asia Pacific Project Preparation Facility

- Asia-Pacific Climate Finance Fund

- Australian Climate Finance Partnership

- Canadian Climate and Nature Fund for the Private Sector in Asia

- Canadian Climate Fund for the Private Sector in Asia II

- Central Asia Regional Economic Cooperation Climate and Sustainability Project Preparatory Fund

- Climate Action Catalyst Fund

- Climate Innovation and Development Fund

- Cooperation Fund for Project Preparation in the Greater Mekong Subregion and in Other Specific Asian Countries

- Domestic Resource Mobilization Trust Fund

- European Union–ASEAN Catalytic Green Finance Facility Trust Fund

- Financial Sector Development Partnership Fund

- Future Carbon Fund

- Gender and Development Cooperation Fund

- High-Level Technology Fund

- Ireland Trust Fund for Building Climate Change and Disaster Resilience in Small Island Developing States

- Japan Fund for Information and Communication Technology

- Japan Fund for Prosperous and Resilient Asia and the Pacific

- Japan Fund for the Joint Crediting Mechanism

- Leading Asia’s Private Infrastructure Fund

- Leading Asia’s Private Infrastructure Fund 2

- Nonsovereign Revolving Trust Fund

- People's Republic of China Poverty Reduction and Regional Cooperation Fund

- Project Preparation and Implementation Support Trust Fund

- Republic of Korea e-Asia and Knowledge Partnership Fund

- Spanish Cooperation Fund for Technical Assistance

- United Kingdom–ASEAN Catalytic Green Finance Facility Trust Fund

Financing Partnership Facilities

- ADB Ventures Financing Partnership Facility

- Clean Energy Financing Partnership Facility

- Community Resilience Financing Partnership Facility

- Health Financing Partnership Facility

- Innovative Finance Facility for Climate in Asia and the Pacific

- International Finance Facility for Education Financing Partnership Facility

- Ocean Resilience and Coastal Adaptation Financing Partnership Facility

- Regional Cooperation and Integration Financing Partnership Facility

- Urban Financing Partnership Facility

- Water Financing Partnership Facility