Attaining Energy Security with Renewable Solutions

Maldives cuts back on diesel by going green with more solar, ocean, and wind, and other renewable energy solutions.

Listen to the article

$3.8 million for 1 project

$17.5 million for 12 TA projects

$843,256 million for 6 activities

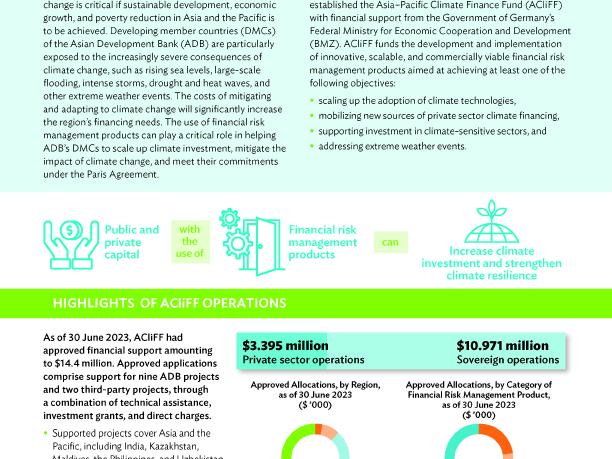

The Asia-Pacific Climate Finance Fund (ACliFF) supports the development and implementation of financial risk management products that can help unlock capital for climate investments and improve resilience to climate change impacts. ACliFF is supporting new, innovative, and commercially viable financial risk management products to expand climate investment and support the attainment of the following objectives: (i) scaling up the adoption of climate technologies, (ii) mobilizing new sources of private sector climate financing, (iii) supporting investment in climate-sensitive sectors, and (iv) addressing extreme weather events. The Government of Germany, through the Federal Ministry for Economic Cooperation and Development, has committed financial support of up to $33 million to ACliFF, thus extending the fund’s availability period to 31 December 2025.

3 January 2024

The Asia-Pacific Climate Finance Fund is supporting ADB’s efforts in Maldives to install grid-scale energy storage, energy management systems, and distribution upgrades in 20 outer islands, all part of Maldives’ push to have renewables deliver one-third of its energy production by the end of 2028.

Maldives cuts back on diesel by going green with more solar, ocean, and wind, and other renewable energy solutions.

As rising temperatures threaten the Hindu Kush Himalayas, the search is on for more innovative solutions for building resilience.

Funded by the Government of Germany, the Asia-Pacific Climate Finance Fund supports financial risk management products that support climate technologies, scale up private sector climate financing, promote climate-sensitive sector investment, and address extreme weather events.

This paper recommends the creation of a dedicated facility to address the two likely major obstacles in accelerating the adoption of disaster risk financing for microfinance institutions in Indonesia, Bangladesh, and other markets in Asia and the Pacific.

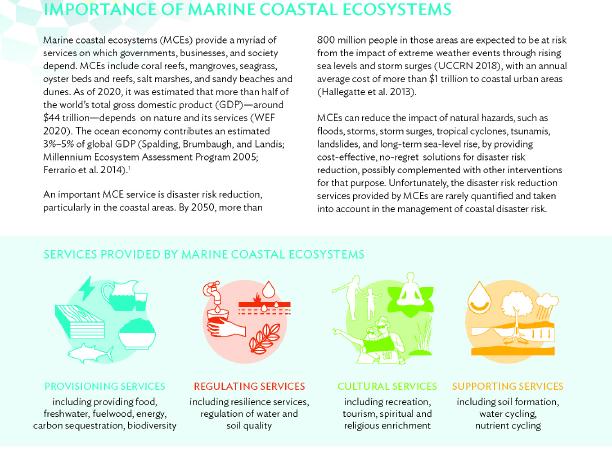

To help prevent marine coastal ecosystems (MCEs) in Asia and the Pacific from being lost or degraded, risk financing such as insurance can help MCEs reduce the impact of natural disasters with cost-effective disaster risk reduction solutions.

ADB is supporting the introduction of a city-level disaster insurance scheme to increase the ability of city governments to respond quickly and effectively to disasters, through funding support from the Asia-Pacific Climate Finance Fund.