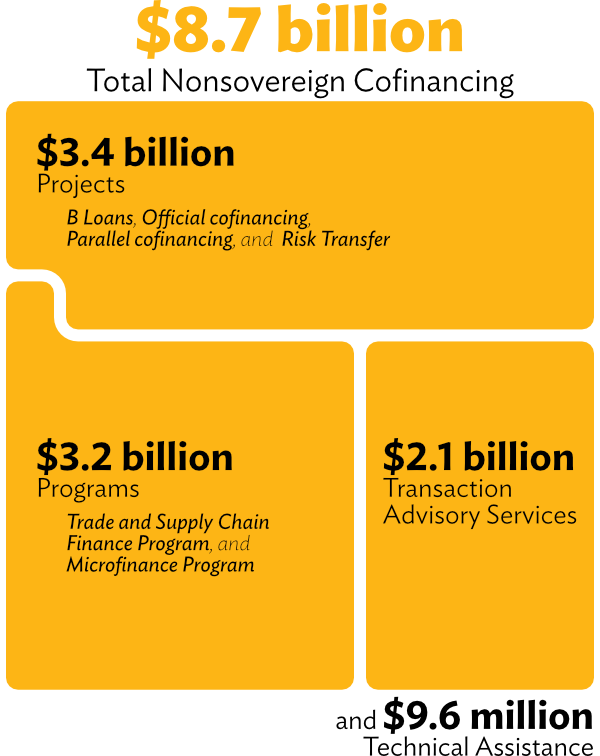

In 2024, nonsovereign cofinancing surged to $8.7 billion, marking a 26% jump from 2023. Transaction advisory services saw the sharpest rise in volume, 369%, primarily due to the $2.1 billion Ninoy Aquino International Airport Project in the Philippines. Cofinancing for technical assistance also saw a significant 134% increase in volume.

Project cofinancing—covering B loans, risk transfers, parallel cofinancing, parallel equity, and official cofinancing—grew by 3.3%, while nonsovereign programs—trade finance, supply chain, and microfinance—saw a more modest uptick of 2.4%. With the trade finance and supply chain program, the more significant change was in transaction volume, which rose to 27,600 from 21,400 the previous year.

This strong performance across all nonsovereign cofinancing modalities boosted the 2024 cofinancing ratio 11 to 2.622, reflecting a year of robust partnerships.

Projects

Long-term project cofinancing increased slightly from $3.3 billion to $3.4 billion in 2024. One of the notable projects completed was the Gulf Solar and solar battery with energy storage project in Thailand, whose financing package included $260 million from ADB and $529 million in parallel loans from key partners, including the Asian Infrastructure Investment Bank, DEG - Deutsche Investitions- und Entwicklungsgesellschaft (German Development Finance Institution), the Export-Import Bank of China, and KEXIM Global (Singapore). ADB also provided $31.4 million in blended concessional financing from the Clean Technology Fund to support the execution and operating risks of solar–battery energy storage systems.

The project cofinancing modalities utilized in 2024 are as follows:

B Loans

B loans are loans funded by commercial banks and other eligible financial institutions with ADB acting as a lender. Participants benefit from ADB’s status as a multilateral development institution, including its relations with governments and experience in a certain sector. In Pakistan, ADB and SAFCO Venture Holdings Limited (SAFCO) inked the sustainable aviation fuel project, with an $86.2 million financial package for the construction and operation of a sustainable aviation fuel (SAF) facility in Sheikhupura, Pakistan. This is the first private sector-led SAF initiative in Asia and the Pacific. The financing includes $41.2 million from ADB’s ordinary capital resources (OCR) and $45 million in syndicated loans, including B-loans from the Emerging Africa & Asia Infrastructure Fund, an emerging market infrastructure debt fund. The International Finance Corporation is providing a syndicated parallel loan. The project is expected to pioneer private sector participation in renewable aviation fuel and contribute to decarbonizing air travel.

Official Cofinancing

Official cofinancing is where ADB cofinances with bilateral and multilateral partners, including public sector lending windows of export credit agencies. In 2024, ADB and Bogd Bank JSC signed a $15 million loan to support micro, small, and medium-sized enterprises (MSMEs) in Mongolia, with a strong focus on women-led MSMEs and green finance. The financing package includes $14 million from ADB, of which half is earmarked for small businesses led or owned by women; and $1 million from the Canadian Climate Fund for the Private Sector in Asia II (CFPS II) administered by ADB. The CFPS II loan will fund climate finance initiatives for MSMEs, including the purchase of energy-efficient equipment and small-scale renewable energy installations.

Parallel Cofinancing

Parallel cofinancing is provided by third-party cofinanciers to a project alongside ADB. This can either be a parallel loan, which is a third-party loan in transactions that have ADB’s direct loan or equity participation; or parallel equity, which is a third-party equity investment in a private equity fund or a transaction where ADB makes a direct investment. In 2024, ADB, the Leading Asia’s Private Infrastructure Fund (LEAP), and the Fourth Partner Energy Bangladesh Limited (FPEBL), partnered to implement a solar power project in Bangladesh that will develop, construct, and operate a portfolio of solar photovoltaic power systems installed on the rooftops of commercial and industrial (C&I) buildings in Bangladesh. These will have an aggregate capacity of up to a 50-megawatt peak. The project also aims to establish a new portfolio financing structure for rooftop solar in Bangladesh by aggregating a diversified portfolio of C&I users through a single borrower.

Risk Transfer

A risk transfer is an agreement between ADB and a financing partner under which—through insurance policies, risk participation agreements, or other similar contracts—the partner assumes a portion or all of ADB’s risk of loss. In 2024, ADB and Vastu Housing Finance Corporation Limited (Vastu) committed up to $70 million to enhance access to affordable and sustainable housing loans in India’s underserved states. The project involves ADB providing long-tenor financing to Vastu to on-lend for housing loans, with 90% of financing allocated to low-income borrowers, prioritizing women. At least 15% of such loans will be directed towards new-to-credit borrowers, and at least 50% will be to borrowers in lagging states in India. The remaining 10% of the loan will be used to provide sustainable housing loans.

Paving the way for EV in the Philippines

ADB has partnered with Ayala Corporation to drive the growth of the electric mobility ecosystem in the Philippines. Through the Ayala Electric Mobility Ecosystem Project, a financing package of up to $100 million will be used to procure and install electric vehicle charging stations (EVCS) and to purchase electric vehicles for commercial distribution in the country.

The package includes a blend of ADB financing and a concessional loan from the Canadian Climate and Nature Fund for the Private Sector in Asia (CANPA). The project will develop a network of EVCS in the Philippines and accelerate the deployment of EVCS infrastructure through an innovative pricing structure structure. A portion of the ADB financing will be allocated to procure electric vehicles from leading manufacturers.

Established in 2024, CANPA is a trust fund managed by ADB, supported by a commitment of Can$360 million from the Government of Canada. The fund builds on the success of two previous Canadian climate funds and supports climate and nature-based solutions, while also promoting gender equality in Asia and the Pacific.

“This project is a significant step towards a sustainable and low-carbon future for the Philippines,” said ADB country director for the Philippines Pavit Ramachandran.

Programs

Trade and Supply Chain Finance Program

International trade drives economic growth and development, and ADB’s Trade and Supply Chain Finance Program (TSCFP) plays a key role in bridging market gaps and delivering maximum development impact from trade. TSCFP does these through a dual-track strategy: (i) guarantees and loans to bridge market gaps, and (ii) special initiatives to implement solutions to trade-related problems, such as resilience, transparency, sustainability, and inclusion.

In 2024, TSCFP executed more than 27,600 transactions valued at $4.9 billion through partnerships with over 180 active international banks and 6 insurance partners. Out of this, $2.9 billion was cofinanced. By leveraging strategic partnerships, TSCFP reinforced its position as a leader in trade-based development and poverty reduction.

TSCFP’s approach to partnerships combines operational solutions, which address immediate trade finance gaps through targeted guarantees and loans, with thought leadership that drives innovation, builds capacity, and delivers impactful knowledge products. TSCFP’s partnerships are not merely transactional; they aim to transform trade ecosystems, ensure resilience, and align with broader development goals.

Partnerships for closing trade gaps

TSCFP worked with partners to help achieve market resilience and address trade finance gaps. In a pioneering effort, TSCFP partnered with the United Nations Office on Drugs and Crime to enhance trade-based money laundering detection in five countries: Bangladesh, Mongolia, Nepal, Pakistan, and Sri Lanka. This collaboration with financial regulators introduced new data elements to enhance detection of suspicious transactions, and trained over 700 officials, boosting suspicious transaction reports by 398% in Pakistan and 148% in Bangladesh. In September 2024, TSCFP published Transforming the Fight Against Trade-Based Money Laundering: New Data and Partnerships and presented the pilot findings at a United Nation’s Office on Drugs and Crime conference held in Latvia.

TSCFP also teamed up with the Global Language of Business (GS1) to integrate carbon tracking and labor standards into supply chains, improving transparency and compliance, with plans to scale in the coming years. In 2024, TSCFP and GS1 completed the development of a detailed data model, mapped the Sri Lanka textiles supply chain end to end, and demonstrated the functioning of a 2-D barcode as an effective data carrier. GS1 authored a report outlining the completion of this first phase of work in Sri Lanka, positioning to leverage the supply chain mapping, to track and report carbon emissions.

Also in 2024, TSCFP joined the International Trade Center’s (ITC) SheTrades initiative, offering multilingual trade training for women entrepreneurs and developing an AI-powered environmental, social, and governance toolkit for small and medium enterprises with ITC.

TSCFP, alongside the International Chamber of Commerce and the Government of Singapore, launched the Digital Standards Initiative (DSI) to digitalize trade by 2030. To support DSI’s global efforts, in 2024, ADB established a multilateral development bank working group on trade digitalization.

Microfinance Program

Micro, small, and medium enterprises (MSMEs) are the backbone of the Asia and Pacific economy, yet they continue to face significant funding barriers. Limited access to formal credit, lack of credit history and collateral, and small loan sizes hinder their growth. Similarly, microfinance institutions (MFIs) and non-bank financial institutions (NBFIs) struggle to secure commercial financing due to perceived higher risks.

ADB’s Microfinance Program (MFP) bridges this market gap by sharing default risks of MFIs/NBFIs with partner financial institutions (PFIs), including commercial banks and wholesale lenders.

In 2024, the MFP significantly advanced financial inclusion across nine developing member countries—Bangladesh, Cambodia, Georgia, India, Indonesia, Kazakhstan, Nepal, Philippines, and Uzbekistan—channeling $533 million in financing to MFIs and NBFIs. This supported over 1 million beneficiaries, most of them women. The MFP also extended its reach in Central and West Asia, welcoming a new partner MFI in Kazakhstan in late 2024.

Since its inception, the program has engaged with 76 private finance institutions and MFIs, reinforcing its commitment to inclusive economic growth, poverty reduction, and climate resilience across Asia and the Pacific.

Beyond financing, MFP engaged with technical partners to strengthen MFI operations, plus promote climate risk adaptation and disaster resilience through initiatives such as home improvement loans and microinsurance.

Accessible financing to climate-vulnerable small businesses

MFP, in collaboration with the Climate Change and Sustainable Development Department, developed a climate change adaptation framework in 2024. The framework aims to (i) encourage private capital to flow towards farm-dependent livelihoods in areas vulnerable to climate change; (ii) expand funding to women, who bear a disproportionate burden of climate-related adversities; (iii) integrate climate change risk assessment and adaptation planning in MFI operations; (iv) build awareness of climate change issues, adaptation measures and impact on micro-borrowers; and (v) develop new climate change risk adaptation products to provide risk-cover to micro-borrowers under climate change-related calamities.

MFP has already partnered with 8 MFIs in India to mobilize and deploy private capital for climate adaptation. By the end of 2024, MFP has facilitated $88.4 million in adaptation financing benefiting 339,000 small and marginal women farmers. Of this amount, 45% was directed to highly climate-vulnerable areas, 34% toward moderately vulnerable areas, and 21% to lower-risk zones. MFP plans to broaden this initiative towards more partner MFIs not only in India but in other developing member countries such as Bangladesh, Cambodia, Indonesia, Philippines, and Uzbekistan. By strengthening financial resilience, the program helps small businesses and farmers adapt to a changing climate while securing their livelihoods.

Technical Assistance

In 2024, cofinancing for technical assistance (TA) initiatives reached $9.6 million.

ADB supported an investment in India’s Mahadhan Agritech Limited (formerly Smartchem Technologies Limited) to help improve the climate resilience of smallholder cotton, pomegranate, onion, banana, and sugarcane farmers through enhanced soil management.

ADB Ventures Investment Fund 1, a venture capital financing facility, invested $4.6 million in four new startups and $2.8 million in follow-on funding for four existing ventures. The new ventures include Tiger New Energy, deploying battery-swapping stations to enhance mobility in Bangladesh; IBISA, offering a satellite-driven climate insurance platform; InnoCSR, delivering soil stabilizers for sustainable brick production; and Electrifi, supporting India’s fleet electrification with a comprehensive mobility-as-a-service model.

Concurrently, the ADB Ventures Seeds Program (a program that provides catalytic funding to early-stage companies with tech-enabled solutions and receives cofinancing from the Republic of Korea) has facilitated technology transfers and knowledge exchange across 13 ADB developing member countries. Among the investments for 2024 are Biodefense, extending seafood shelf life with innovative coatings; Humble Sustainability, optimizing e-waste reduction through re-commerce; Silta Finance, streamlining green infrastructure financing with AI; and Terra Oleo, producing sustainable fats and oils via biotechnology

Promoting soil management best practices in India

In Maharashtra, most smallholder cotton farms rely on rain, with limited access to irrigation. Farmers do not often use government soil analysis services, relying only on bulk fertilizers. Many are unaware of the role of micronutrients and balanced soil nutrition.

While farmers have noticed worsening drainage issues during more intense rainfall events, they did not fully understand how soil texture affects water retention and drought resilience.

To address this gap, ADB, alongside its investment in Mahadhan Agritech Limited (formerly Smartchem Technologies Limited), provided technical assistance (TA) to improve soil management and climate resilience of smallholder cotton, pomegranate, onion, banana, and sugarcane farmers.

The TA is training farmers (independent of their use of the company’s products) on climate-smart soil management practices, starting with using the soil analysis services offered by the government. This will help them understand soil conditions better and apply nutrients suited to specific crop cycles. The training also includes financial literacy that focuses on farm budget management. Finally, the TA promotes farm practices that contribute to soil texture improvements, including crop rotation, intercropping, adding organic matter, and reducing tilling. Through these measures, farmers can improve soil health, which will increase resilience to droughts, extreme rainfall, and heat waves.

Transaction Advisory Services

In 2024, transaction advisory services (TAS) mobilized more than $2 billion in private sector investments through public-private partnerships. This includes over $2 billion for the expansion and modernization of the Ninoy Aquino International Airport (NAIA) in Manila, Philippines; and approximately $5 million for an elder care demonstration project in Yichang, Hubei, in the People’s Republic of China.

The Philippine NAIA project aims to upgrade runways, optimize air traffic management, and expand terminal facilities, increasing the airport’s capacity from 33.2 million to 62 million passengers. These enhancements will ease congestion, improve the passenger experience, and stimulate tourism, solidifying NAIA’s role as an economic hub for the country.

The PRC, meanwhile, requires new strategies and financing to resolve issues associated with its aging population. In 2024, ADB facilitated a partnership between the country’s public and private sectors, mobilizing $5 million in private financing toward an ongoing public project for elder care in the Yichang municipality of Hubei Province. Under this transaction, a private operator will manage two modern and inclusive care facilities for older people, with a combined capacity of about 1,200 beds, around 20% of which will be reserved for patients facing financial difficulties.

ADB provides advisory services to develop bankable public–private partnership projects that attract private sector investment. This includes managing the Asia Pacific Project Preparation Facility, a multi-donor trust fund supported by contributions from the governments of Australia, Canada, Japan, and the Republic of Korea.

Expanded Capacity for Tourism and Trade

For 65 years, the Ninoy Aquino International Airport (NAIA) has been the Philippines’ primary gateway. However, with over 45 million travellers annually, the airport is struggling to meet demand efficiently.

To address infrastructure and capacity challenges, the Government of the Philippines partnered with the private sector to modernize NAIA. ADB helped prepare and structure a $2.1 billion transaction, ensuring the project’s financial viability and long-term revenue generation.

Key upgrades under the public-private partnership are expanded terminal facilities to accommodate more passengers, runway upgrade for smoother operations, and optimized air traffic management. These improvements will increase NAIA’s capacity to 62 million passengers per year, enhancing connectivity and boosting tourism.