Listen to the article

ADB collaborates with financing partners to invests in projects that support governments of developing member countries (sovereign operations) and for privately held or state-sponsored companies (nonsovereign operations).

For sovereign operations, financing partners cofinance with ADB through two modalities: project-specific cofinancing and trust funds. These could be in the form of loans, grants, or technical assistance (TA).

For nonsovereign operations, financing partners cofinance with ADB through projects, programs, TA, or transaction advisory services. ADB works with bilateral or multilateral development partners and commercial entities. Some trust funds also support nonsovereign operations.

By working with financing partners, ADB sets itself on a stronger financial and technical position to support developing members countries (DMCs). Our partners also improve coordination and reduce fragmentation of DMC support, delivering outcomes with farther-reaching and more lasting impact.

Sovereign Operations

There are two ways our partners support ADB’s sovereign operations: through project-specific cofinancing (PSC) or through trust funds. PSC support is direct investment in specific programs, projects, or technical assistance (TA). With trust funds, partners are often guided by their priority sectors and DMCs and would naturally support projects that focus on these priority themes or areas. As such, they establish a trust fund earmarked for such initiatives or support an existing one fully administered by ADB.

In 2024, ADB’s partners committed $6.2 billion to support sovereign grants, loans, TA, and investments coursed through 69 PSCs and 113 trust funds–supported projects.

While total cofinancing declined from the previous year, the number of cofinanced projects grew by 38%, reflecting a strong commitment from partners.

ADB also administered 49 active trust funds in 2024. These trust funds support various development priorities that partners share with ADB, such as disaster risk management, clean energy, private sector development, and more.

Project-Specific Cofinancing Trust Funds

Nonsovereign Operations

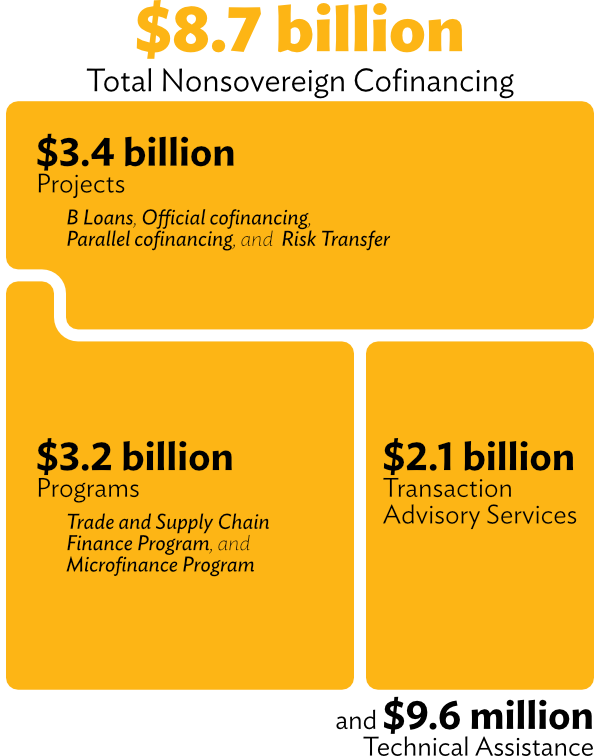

In 2024, nonsovereign cofinancing surged to $8.7 billion, marking a 27% jump from 2023. The biggest leap came from transaction advisory services, which quadrupled in volume, while cofinancing for technical assistance also saw a significant 134% increase.

Project cofinancing—covering B loans, risk transfers, parallel cofinancing, parallel equity, and official cofinancing—grew by 3.3%, while nonsovereign programs—trade finance, supply chain, and microfinance—saw a more modest uptick of 2.4%.

This strong performance across all nonsovereign cofinancing modalities boosted the 2024 cofinancing ratio to 2.6, reflecting a year of robust partnerships.

Projects Programs Technical Assistance Transaction Advisory Services